The benefits of unitised portfolios

Financial advisers are committed to delivering the very best possible investment outcomes for the clients who entrust them with their hard-earned wealth. Some will manage client portfolios in-house, while others will outsource investment management and use a model portfolio service (MPS). MPS portfolios have many benefits for clients – expert investment management, diversification across asset classes and professional asset allocation. More and more advisers are, though, recognising the benefits of unitised portfolios, which take the advantages of MPS and build on them, providing important additional benefits both for clients and for the adviser business.

What is a unitised portfolio?

A unitised portfolio means that while clients continue to benefit from expert fund selection, asset allocation and portfolio construction, they also enjoy all the investment advantages and the transparency and governance benefits of a fund structure. Rather than being in an isolated individual portfolio, their investments are now held as units within a collective fund structure. The benefits for the client and for your business can be considerable.

Funds

A flexible route to improved portfolio outcomes Funds are a flexible investment solution that can be used in a variety of ways to enable your clients and your business to enjoy the significant benefits of unitisation.

One option is to provide an individual fund for each portfolio risk profile. Another is to use a smaller number of ‘building block’ funds in combination, blending them in different proportions to create portfolios tailored to a range of risk profiles.

Your funds could also be used as risk-rated ‘cornerstone’ core holdings in portfolios, with other ‘satellite’ holdings. ‘Building block’ funds can either be risk-graded multi-asset funds or single-strategy vehicles, investing in asset classes such as global equities or bonds. The decision is entirely yours and depends on which approach best suits your clients’ needs. In all cases, you have the option of managing the unitised portfolios in-house or you can call on the expertise of Marlborough’s highly experienced multi-asset investment team. For companies with higher levels of assets under management, funds can also provide a cost-effective home for segregated mandate portfolios, with a number of third-party managers bringing their expertise to your client portfolios.

Once you have a fund structure in place, it is a straightforward matter to consolidate further by transferring in other portfolios at the appropriate time so those clients too can enjoy the benefits of unitisation. If you decide unitisation is right for your clients and your business, as a first step we will work with you to clearly understand your target market and their needs. We will assist with the design of suitable products, highlighting the options available and helping you navigate the regulatory process to launch your funds. Marlborough Group, with its established and respected fund governance (Authorised Corporate Director) services, is committed to working in partnership to enable your business to achieve its growth potential by delivering great outcomes for your clients

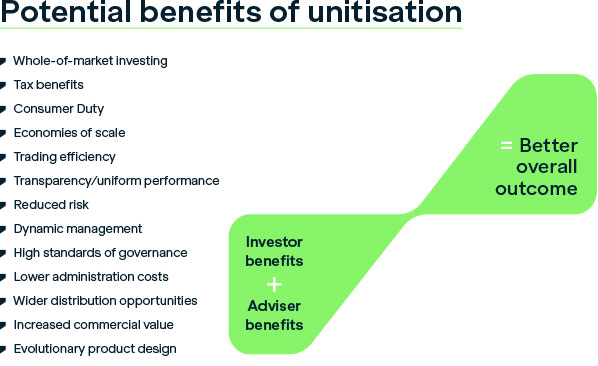

Benefits of unitisation

For clients

Unitised portfolios offer considerable benefits for your clients. The investment managers will have access to a wider range of investment opportunities, the fund wrapper provides tax advantages for client portfolios not held in an ISA or SIPP and the economies of scale offered by a fund structure can translate into lower transaction costs.

Wider range of investment opportunities

Unitised portfolios can access a wider range of investment opportunities, such as exchange traded funds and investment trusts. This can help to reduce costs and increase options for exposure to assets such as commodities or precious metals.

Tax advantages

When individual portfolios held outside a SIPP or ISA are rebalanced, the sale of an asset can trigger a Capital Gains Tax event. This is not the case within a fund structure, where internal transactions are sheltered from CGT. The liability is only triggered when the client sells their overall investment. This is an increasingly important consideration, with the annual CGT allowance halved to £6,000 in April 2023 and to be halved again to £3,000 from April 2024.

In addition, some (but not all) MPS portfolios charge investors VAT on investment management fees. For those using a fund structure there is no VAT on the management fees.

For advisers

Unitised portfolios also offer advantages for your business, with a reduced administrative burden and increased trading efficiency. In addition, the commercial value of your business is likely to be substantially increased. The valuations of firms with their own funds are considerably higher and this is partly because of the reliable income they receive from the fund’s annual management fees.

Consumer Duty

We believe the benefits described above for clients can help advisers meet the increased regulatory responsibilities heralded by the FCA’s Consumer Duty, which requires them to demonstrate products meet their clients’ needs and represent value for money.

Economies of scale

Because many investors have units in the same fund structure, this creates economies of scale which can reduce costs for the clients as well as the adviser business.

Increased trading efficiency

In a fund structure, when an underlying holding is bought or sold, the transaction is a single trade at one price for all investors. This means in a unitised portfolio returns should be consistent over any given time period for all investors.

Transparency

Using the fund structure means unitised portfolios have a regulatory requirement to publish a standardised set of documents providing information for investors and potential investors. The consistent nature of these documents makes comparisons with other products more straightforward.

Uniform client performance

Investors in a unitised portfolio all hold the same assets, and in the same proportion, so performance will be uniform. This helps with delivering consistent outcomes, reducing queries and increasing transparency.

Reduced out-of-market risk

When some MPS portfolios are rebalanced, the client can be ‘out of the market’ for two to three days, which could mean they miss out on significant gains. With a fund structure, there is no delay between the sell and the buy, which reduces this out-of market risk.

Dynamic management

While some MPS portfolios will only be rebalanced at fixed intervals – for example, monthly or quarterly – the investment managers of unitised portfolios can be more dynamic, enabling them to act swiftly as market conditions change.

High standards of governance

Under FCA regulations, each Open-Ended Investment Company (OEIC) fund must have an Authorised Corporate Director (ACD). The ACD acts as a steward overseeing the running of the fund and helping to protect the best interests of investors.

Reduced administrative burden

The administrative work required to operate unitised portfolios can be significantly less than for individual client portfolios. This can free up considerable staff time and also reduce costs for investors.

Wider distribution opportunities

With unitisation, funds can be more widely distributed and provide additional solutions outside your existing distribution channel, such as investment solutions to those that cannot necessarily afford personal investment advice but would benefit from your investment proposition.

Increased commercial value

Adviser firms operating unitised portfolios through a regulated fund structure with strong governance are often seen as having a higher commercial value. This is because of the recognised greater long-term business efficiencies of funds, their resilience in asset retention and the reliable income from annual management fees.

Continuing evolution – ‘look-through’ facility

Unitised portfolios are continually evolving to further enhance the service provided for investors. For example, the Marlborough Group’s Select Platform is developing a ‘look-through’ facility that will enable unitised portfolio investors to see the individual underlying companies held in their portfolios.

{{download}}

Conclusion

More and more firms are recognising the benefits of unitising portfolios, which can provide significant advantages for both investment clients and adviser businesses. The Marlborough Group is committed to working with like-minded businesses to support their growth and our companies can provide a range of expert services to assist with unitisation. If you would like to find out more about unitised portfolios and how we can support the growth of your business please contact martin.ratcliffe@marlborough.co.uk.