Multi-Asset Team Q4 Review and 2024 Outlook

In this article we share our insights about the key topics on investors’ minds and look forward to what to expect in 2024.

In 2023, we have seen significant progress in the battle against inflation in developed markets. This material easing of inflation makes it all the more challenging for central bankers to continue to argue that it will be necessary to keep interest rates on hold for longer. As we move into 2024, we expect central bankers to leave this narrative behind and start to signal interest rate cuts. But what will this mean for markets and what risks and opportunities do we see on the horizon?

Market review

Many expected 2023 to be a very challenging year for both the global economy and stock markets, due to the impact of higher interest rates. As a result, most market commentators and economists were pessimistic. This view, however, turned out to be wrong and 2023 delivered a better outcome than many anticipated. There are several reasons for this. Firstly, inflation has fallen dramatically and continues to trend lower. This has enabled central bankers to end their interest rate hiking programmes and signal that they do not need to further increase rates. Economic activity has been more resilient than anticipated and recessions have been avoided by major developed market economies. Finally, companies’ earnings have also held up well. All of this combined to provide a solid foundation for a pick-up in both equity and bond markets in the final quarter.

Inflation to deflation?

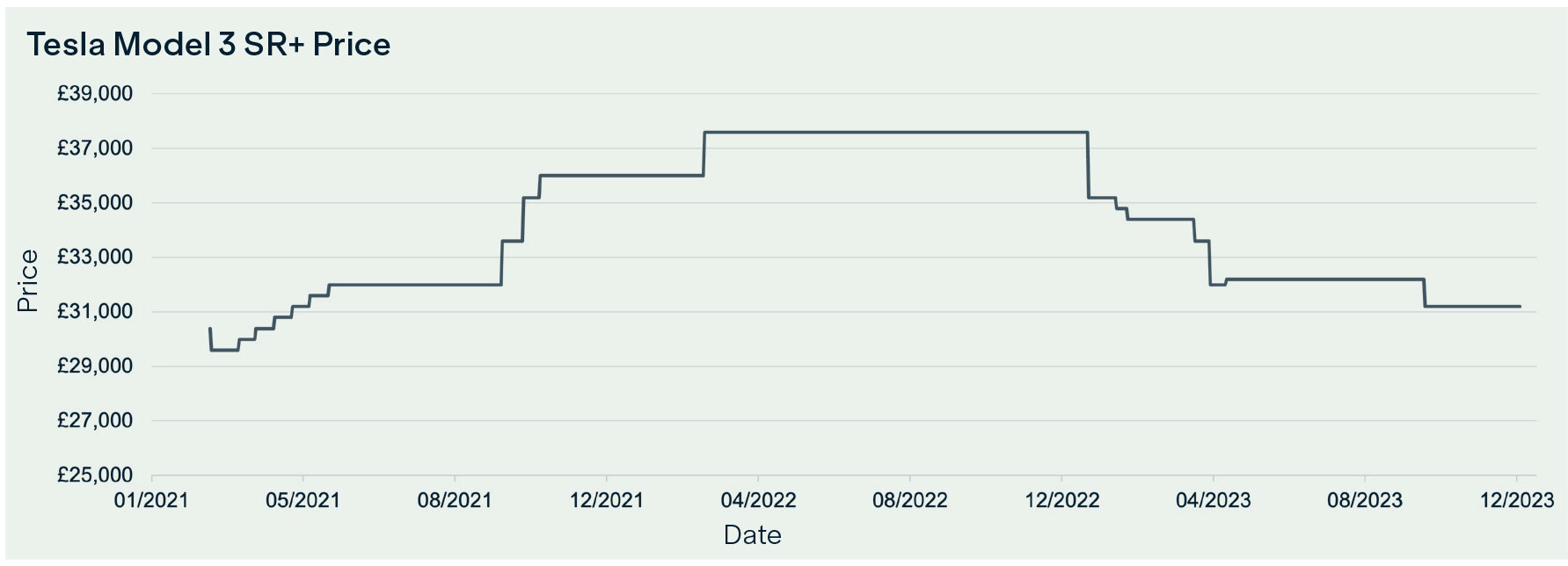

Inflation has been at the heart of the global economic story for the past two years. However, it is worth highlighting that significant progress was made in 2023. After several shocks, the normalisation of supply chains has helped to increase supply and bring down the price of goods, which are now more readily available. Additionally, we are seeing lower demand, with the pent-up demand that built up during COVID now played out. As an example, we saw huge demand for new cars as we emerged from COVID, and that demand has now been satisfied. Today we are seeing less demand for high-end goods like cars, which is introducing more price competition, as sellers look to entice buyers back into the market. For example, the asking price for a Tesla has fallen dramatically this year. Tesla reduced the prices of its Model 3 and Model Y in the UK twice this year. The first price cut was in January, when the prices of both models were lowered by around £7,000 each. The second price cut was in March, when the price of the cheapest Model 3 was reduced to £38,790, representing a £4,200 saving over the car’s previously discounted retail figure.

This increase in supply and easing of demand can only be a good thing for consumers, helping to bring inflation under control more quickly.

However, markets remain on edge about the potential for inflation to accelerate again. The conflict in the Middle East has the potential to lead to an inflation spike because it could lead to wider conflict, which could ultimately disrupt oil production and push up oil prices. However, to date, this has been avoided, because the conflict has not spread, although it remains a risk. In fact, oil demand is expected to fall in 2024, due to lower demand as higher interest rates continue to squeeze consumers. This could help to keep a lid on inflation.

From transport to clothing and footwear, we have seen slowing price rises across the board and we would not rule out inflation falling below the 2% target set by many central banks and even, potentially, turning negative to create deflation, as some commentators are already predicting.

Interest rate rises to rate cuts

We do not think the political will is there to keep rates higher for longer in an election year. After all, a recession and job losses are unlikely to be popular with voters.

The great thing about falling inflation is it gives central banks the necessary room to cut interest rates. The common belief is interest rates will fall in 2024. However, they are expected to settle at a higher level than we have grown used to over the past decade.

So, where will interest rates get to and when? And what does that mean for cash investors?

With interest rates rising at the fastest pace in history, savers have been clambering to open up cash ISAs, which have attracted record inflows, with savers piling more than £9 billion into cash ISAs between May and July this year.

The attraction of today’s higher interest rates is clear, especially since nothing like them has been on offer for such a long time. However, can you use cash to achieve your long-term financial goals – or are these cash offers ultimately likely to derail your efforts to meet your financial objectives?

Unfortunately, cash has, historically, achieved significantly lower returns than investments like equities or bonds over time. The added complexity is that inflation is ever present and can severely erode your return on cash in real terms.

The greatest risk to cash savings in 2024 is interest rate cuts. And in our view it is not a question of if we get interest rate cuts, it is a question of when. We fully expect to see central banks cutting interest rates in 2024.

We are in the middle of a tug-of-war between markets and central bankers. Markets are pulling for interest rate cuts sooner and central bankers are pulling back in the direction of keeping interest rates higher for longer. We believe central bankers will only be able to pull for so long before they run out of steam, as falling inflation weakens the case for keeping interest rates higher. Perhaps even more importantly, the socioeconomic impact of higher rates is likely to lead to increased political pressure to bring interest rates down.

60/40 portfolios to steal the limelight

For much of 2023, cash has been king, but investors may soon be ready to deploy that capital into risk assets, turning the spotlight back towards 60/40 portfolios as we move into 2024.

If, as we expect, interest rates do fall in the year ahead, then this provides a positive backdrop for risk assets such as equities and bonds to perform well relative to cash. In the end, the divergence in returns between cash and risk assets is only likely to increase as interest rates fall, catapulting many investors back into the market as they try to avoid missing out.

We believe this will benefit the 60/40 portfolio and we are likely to see a tidal wave of flows back into markets from the sidelines, notably cash funds.

Given that we have had higher interest rates for a period, some businesses will struggle, and active managers are likely to benefit from their freedom to focus on what they believe to be the strongest companies. This reinforces the benefit of investing in a globally diversified multi-asset portfolio.

Portfolio positioning

Equities

We continue to expect to see a moderate slowdown in economic growth as we enter 2024 and easing inflation could bring forward interest rate cuts. We have, for the first time, seen a governor of the Federal Reserve openly talking about the potential for interest rate cuts.

This could be a critical point for asset classes that have lagged in 2023, particularly those that are more interest rate sensitive, such as smaller companies.

Within equities we are neutrally positioned, but underneath the bonnet we are addressing the potential for improvements from these overlooked market areas.

The US technology giants have had a strong run in 2023 and we believe they will continue to perform well in 2024, as they again deliver robust earnings. However, we believe the most attractive opportunities will come from other sectors, as a wider range of companies benefit from the improving interest rate outlook. So, we have reduced our exposure to tech mega-caps and allocated to large and mid-caps.

Similarly, in the UK, we have dialled down our exposure to large cap quality stocks to add to smaller companies, which we expect to benefit from the reduction in financing costs as interest rates fall.

Bonds

Bonds are looking significantly more attractive today than they have for a long time. This is mainly because interest rates look like they have peaked, which means bonds are likely to deliver better returns from here. Investors are now in a position to collect a very healthy coupon (interest payment) from holding a bond and this is quite an attractive option, as you are being paid to wait for the price rises that interest rate cuts are likely to bring.

Within the bond space, there are two key areas: bonds issued by governments and bonds issued by companies. We like government bonds and have moved to an overweight position in this segment of the market. One of the benefits of higher interest rates on bank deposits is that government bonds also now pay a higher level of interest. This means investors are compensated today as they wait for interest rates to fall. Falling interest rates are likely to bolster government bond performance. We prefer government bonds with a longer time horizon, as they tend to benefit more in a falling interest rate environment.

We are a little more cautious when it comes to company bonds. We reduced our exposure to high-yield bonds in the third quarter, as we expect the impact of higher interest rates to continue to feed through to the corporate sector, creating the potential for some companies to find it difficult to refinance their debt as it matures. The number of companies looking to refinance their debt will increase next year, which was one of the reasons we decided to reduce our exposure to high yield.

We expect government and corporate bonds to take the spotlight in 2024, and we favour these asset classes over cash and cash instruments, such as money market funds.

Market Outlook

As we begin 2024, we expect a similar level of caution from investors as that seen at the beginning of 2023. This is due to several factors. Firstly, 2024 is going to be one of the biggest years in history for elections, with 76 countries potentially going to the polls. This means 4.2 billion people could vote, representing 51% of the global population. This uncertainty has the potential to create short-term volatility. Of the elections with the most significant global market implications, Taiwan’s presidential election will be the first to come into focus in January. The successful candidate’s stance towards China will be the key element for investors to watch. The US presidential election will take place in November and is likely to dominate the headlines and leave investors feeling on edge. Finally, we have the UK election, which must be called by 17th December at the latest.

Another factor occupying investors’ minds will be the expected slowing in economic growth. We can already see signs that higher interest rates are impacting consumer behaviour and spending on big-ticket items is dwindling. Additionally, household savings are falling and credit card balances are rising, which provides further evidence of the potential for a slowdown as we enter 2024. However, we do not anticipate a dramatic slowdown.

Our core view

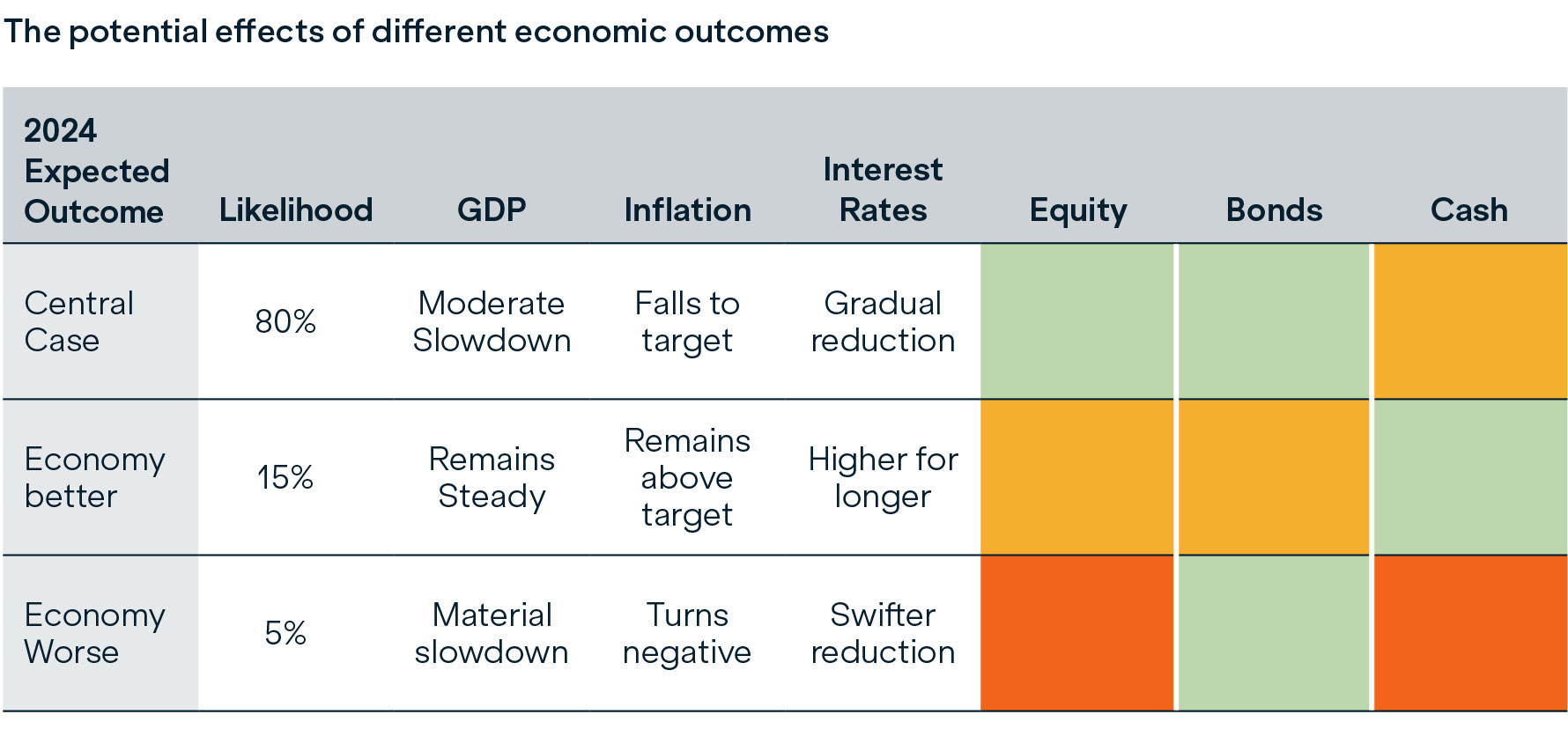

Our central case is that falling inflation will lead to interest rate cuts, and we will see a modest rather than dramatic slowdown in economic growth. This paves the way for government bonds to take the spotlight from cash as investors seek out attractive sources of income. In equities, we expect to see a more broad-based recovery, rather than the picture being dominated by a limited number of technology mega-caps. In this scenario, with bonds and equities performing positively, we would expect stronger returns from 60/40 portfolios.

There is the potential for the economy to remain stronger for longer before a slowdown. If this is the case, it will be positive for the earnings of quality companies and bonds will continue paying a higher level of income until we get the eventual interest rate cuts.

What if we are incorrect? If economic growth is weaker than we anticipate, then this will only serve to accelerate the pace of interest rate cuts, which will lead to more dramatic outperformance from government bonds. Yes, this would be negative for equities, although probably not for very long, because lower interest rates would kick-start the economy, driving up markets.

We believe the path to the next bull market is being forged. We understand that it can be difficult to see this at times, but this is something we all experience on the climb. Finally, it is important to provide a reminder of the benefits of well-diversified multi-asset portfolios and our ability, as experienced investment managers, to reposition these portfolios as market conditions evolve.

Risk Warnings

Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting portfolios. Investments may include emerging market, smaller company and commodity funds which may be higher risk than other asset classes. Investments in fixed interest funds are subject to market and credit risk and will be impacted by changes in interest rates. Changes in exchange rates may affect the value of the underlying investments. Investments in Property funds carry specific risks relating to liquidity. Property funds can go through periods, known as ‘gating’, when it may not be possible to trade in or out of the funds and to access your money during such periods. The portfolios may invest a large part of their assets in funds for which investment decisions are made independently of the portfolios. If these investment managers perform poorly, the value of the portfolios is likely to be adversely affected. Investment in funds may also lead to additional fees arising from holding these funds.

Regulatory Information

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Marlborough or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine together with their own professional advisers if appropriate if any investment mentioned herein is believed to be suitable. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

Issued in the UK by Marlborough Investment Management Limited, authorised and regulated by the Financial Conduct Authority (reference number 115231). Registered office: Marlborough House, 59 Chorley New Road, Bolton, BL1 4QP. Registered in England No. 01947598.

Issued in Europe by Marlborough Investment Management Limited (authorised and regulated by the Financial Conduct Authority) on behalf of IFSL ICAV (authorised and regulated by the Central Bank of Ireland). IFSL ICAV is managed by TMF Fund Management (Ireland) Limited (authorised and regulated by the Central Bank of Ireland). IFSL ICAV is registered under the laws of Ireland with registered number C186352 as an Irish Collective Asset management Vehicle which is constituted as an open ended umbrella UCITS fund with segregated liability between sub funds. Directors: Raymond O’Neill (Irish), Brian Farrell (Irish), Dom Clarke (British), Martin Ratcliffe (British) and Danny Knight (British). Registered office: IFSL ICAV, Mill House, Millbrook, Naas, County Kildare W91 DYY6, Ireland.

Issued internationally by Marlborough International Management Limited is incorporated in Guernsey. Registration No. 27895. Regulated by the Guernsey Financial Services Commission. Licensed under The Protection of Investors (Bailiwick of Guernsey) Law 1987. Guernsey Office: PO Box 146, Level 2, Park Place, Park Street, St. Peter Port, Guernsey, GY1 3HZ